The graphic above was retrieved from: http://www.mygovcost.org/2011/03/11/to-whom-does-

the-u-s-government-really-owe-money/

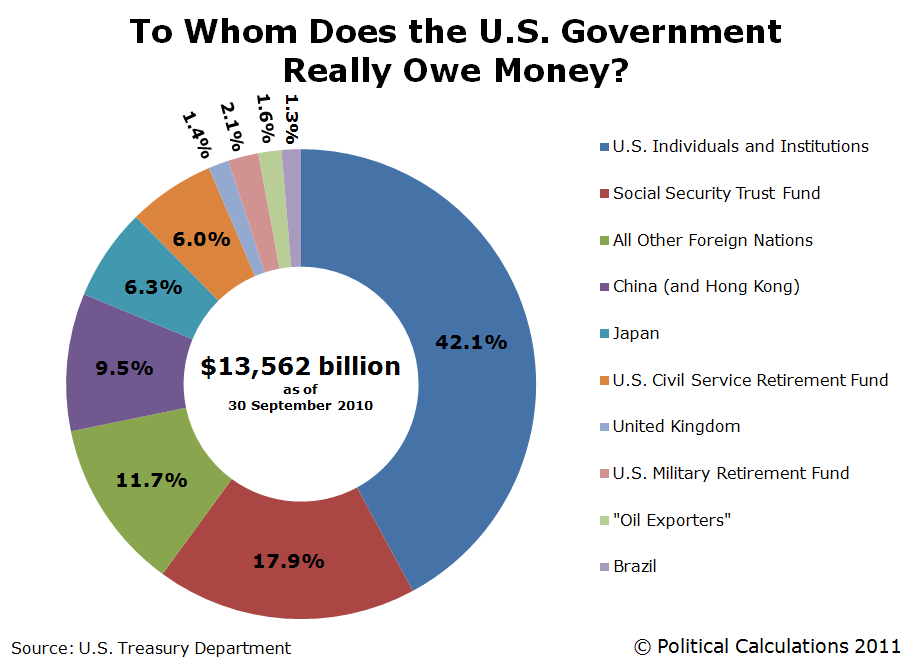

Isn't this interesting! The government is primarily in debt to, not another country, but to us... Is this surreal? Perhaps. But it may have something to do with the nature of fiat currency- printing money as debt.

By giving bonds from the public treasury to the private Fed to compensate them for putting currency into circulation [why doesn't the public government print its own damn money, you ask? Good question! Woodrow Wilson, to whom I am hopefully not related, signed the F. Reserve Act in 1913 after it made its way through Congress], the Fed is allowed to perpetually collect interest from the American people. Money the federal government spends meeting its obligations to the central bankers is money that cannot be spent meeting its obligations to the citizenry.

Of course, members of the private Fed are theoretically appointed by the government, but how impartial can our government's selections be when we are in debt to the institution in question, whose 13 Federal Reserve Banks are composed largely of private sector individuals like Jamie Dimon with their own vested interests? The short answer: Probably not very impartial.

How much U.S. debt does the Fed own? Certainly not all of it- it cannot be blamed directly for all our ills, although we can be sure it has an indirect role beyond these numbers here (we need look no farther than its lax supervision of reckless bets in the private sector that have seriously impaired our economy)- but a remarkable amount nonetheless.

"We found that as of September 29, 2010, the Federal Reserve held 966 billion dollars of the U.S. national debt in the form of U.S. Treasury Securities or Federal Agency Debt Securities, which represents 16.9% of all U.S. individual or institutional debt holdings, or approximately 7.1% of the total national debt" (go to the the URL given above to see the quote in context).

We must also remember that the Fed is sufficiently free from rigorous supervision that: a) These figures are a year and a half old; b) These figures are provided by the U.S. Treasury Department, the same institution that provides the Fed with a share of the U.S. debt in the form of treasury bonds.

Third-party oversight by, say, citizens? Please, what kind of country do you think we live in, a democracy? Cue the laugh-track here.

Very well, you know what I think on the matter. Comment below, and tell me what you think.